MSME Loans

MSME Loans

Our MSME loans are designed to support small and medium enterprises. We provide flexible financing options to help you grow your business, expand operations, or meet working capital needs.

Flexible EMI Options

Enjoy customized EMI plans tailored to your income, making repayments more manageable and convenient.

Loan Approval in 24 Hours

Experience fast-track loan approvals with our streamlined process, getting you the funds you need without unnecessary delays.

Paperless Approval

Simplify your application with our easy approval process, making it quick and hassle-free.

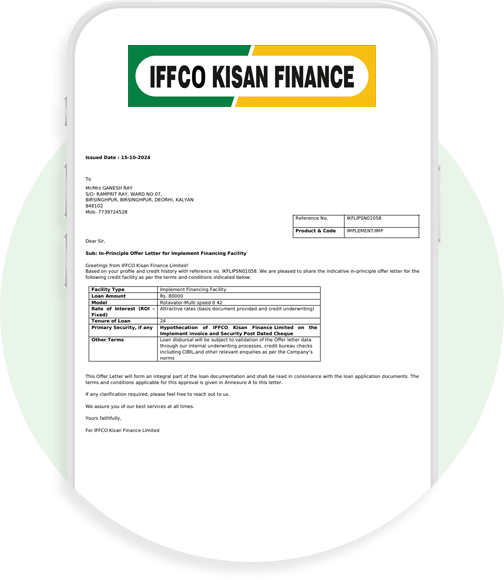

Eligibility Criteria

Customer Profile

1. Eligible Constitutions: Individuals, Proprietorships, Partnerships and Companies

2. Age: 21 years-60 years

Collateral

1. Residential as well as Commercial properties

2. Possession Type: Self Occupied, Rented and Vacant, Open Commercial Plots

KYC Compliance

1. KYC Information of the Applicant, Co-Applicant and Guarantors, as applicable

2. Udhyam Registration Certificate

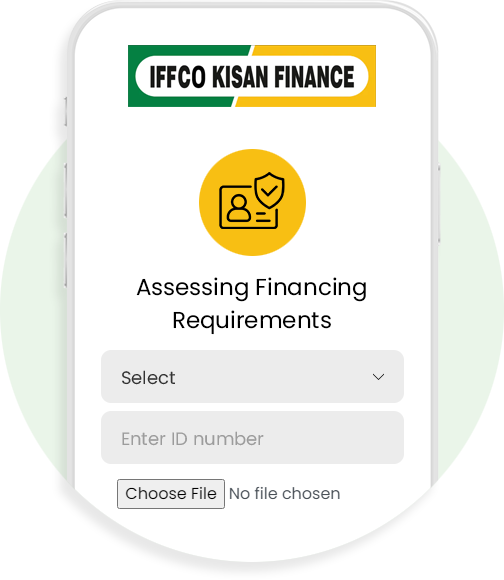

How to Apply?

You can start your application and resume it at a later instance.

Follow these steps to apply:

How to Apply?

Quick, Easy, and Hassle-Free Journey for Your Customers.

Follow these steps to apply:

EMI Calculator

Calculate your Loan EMI in 3 easy steps.

Interest Amount

₹ 3,01,577

Monthly EMI

₹5451.46

Principal Amount:

₹ 621,000

Total Amount:

₹ 653,417.53

IRR Calculator

Simplify your financial analysis with our easy-to-use IRR calculator